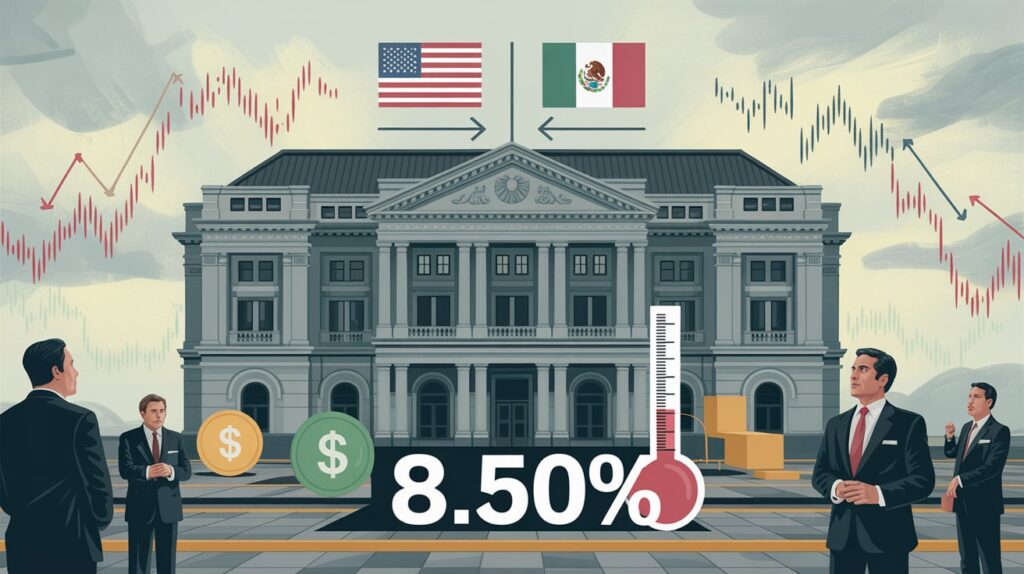

Bank of Mexico Reduces Interest Rate Again Amid Growing Economic Uncertainty

The Bank of Mexico, also known as Banxico, announced a 50-basis-point cut to its benchmark interest rate on Thursday, marking the third consecutive reduction in a series of monetary easing moves. This decision brings the key rate down to 8.50%, a level not seen since August 2022. The unanimous vote from Banxico’s board came as no surprise to financial analysts, many of whom had predicted the move in light of persistent economic challenges and mounting external pressures.

Despite relatively stable inflation figures, the central bank remains cautious. Its statement accompanying the decision emphasized continued uncertainty stemming from global trade tensions, especially those involving the United States, and ongoing weakness in domestic economic activity. These factors, Banxico warned, could weigh heavily on Mexico’s growth prospects in the coming months.

Inflation Remains in Check, But Risks Linger

One of the primary justifications for the rate cut is the country’s recent inflation trajectory. Headline inflation stood at 3.93% year-on-year in April, a modest uptick from March, yet still well within the central bank’s target range of 3%, plus or minus one percentage point. This relatively benign inflation environment has provided Banxico with the flexibility to adopt a more accommodative monetary policy without risking runaway price increases.

Nevertheless, the central bank’s board remains vigilant. In its official communication, Banxico signaled that future rate cuts are on the table, though contingent on evolving economic conditions. “Given the available information, the Governing Board will monitor closely the risks that might affect inflation and the economy, and if conditions allow, could consider similar adjustments in upcoming meetings,” the statement read.

This measured tone reflects a careful balancing act. While inflation is currently under control, external shocks and domestic structural issues present a complex landscape for monetary policy. Among the concerns are global energy prices, currency volatility, and policy shifts in the U.S. that could spill over into the Mexican economy.

Signs of Weakness Persist

Mexico’s economic performance in the first quarter of the year has done little to inspire confidence. Official data released recently shows that GDP expanded by a mere 0.2% during the first three months of the year, narrowly avoiding a technical recession. This sluggish growth is emblematic of deeper structural problems, including low levels of investment, declining productivity, and weakened consumer confidence.

Banxico has acknowledged these issues explicitly, describing domestic economic activity as “fragile.” The bank cited declining industrial output and subdued private consumption as major areas of concern. Furthermore, the services sector, which had shown resilience in previous quarters, is now showing signs of losing momentum.

Given this backdrop, the rate cut is seen as an effort to support economic growth by lowering borrowing costs and encouraging both consumer spending and business investment. However, economists caution that monetary policy alone may not be sufficient to catalyze a meaningful recovery without concurrent structural reforms and improved investor confidence.

U.S.-Mexico Trade Relations: A Source of Volatility

Another key element influencing Banxico’s decision is the increasingly complex relationship between Mexico and the United States, its largest trading partner. Uncertainty surrounding U.S. trade policy—particularly the threat of tariffs and shifts in supply chain strategies—has introduced a layer of unpredictability to the Mexican economic outlook.

While the current administration in the U.S. has not reimposed the sweeping tariff threats that were common under former President Donald Trump, the legacy of those policies continues to cast a long shadow. Mexican exporters and multinational corporations remain wary of sudden changes in trade regulations or geopolitical tensions that could disrupt cross-border commerce.

Banxico has explicitly acknowledged these concerns in its public communications. “Developments in the international environment, especially with regard to trade relations, could exert upward or downward pressure on inflation,” the central bank noted. This dual risk underscores the difficulty of navigating policy in a small open economy that is deeply integrated into global supply chains.

In addition to trade frictions, Banxico is closely monitoring monetary policy shifts in the United States, particularly decisions made by the Federal Reserve. If the Fed continues to maintain or raise interest rates while Mexico lowers its own, the resulting interest rate differential could place downward pressure on the peso, potentially fueling inflation and capital outflows.

Analysts Weigh In: More Cuts Likely

The decision to cut rates was widely anticipated by analysts and market participants, many of whom see it as part of a broader easing cycle aimed at stimulating the economy. In a survey conducted by Reuters in late April, the majority of economists polled predicted that Banxico would cut its rate by at least 50 basis points during its May meeting. Many also foresee further reductions in the second half of the year.

Andres Abadia, Chief Latin America Economist at Pantheon Macroeconomics, stated that “the Bank of Mexico is clearly signaling its readiness to support the economy amid global uncertainty and domestic weakness. As long as inflation remains under control, we expect another 50 basis point cut in the upcoming meeting.”

Alberto Ramos, Head of Latin America Economic Research at Goldman Sachs, echoed this sentiment. “The tone of the statement suggests a dovish outlook,” he noted. “While the bank is cautious, it acknowledges that the current economic weakness justifies additional monetary stimulus. We expect further cuts, though they will be data-dependent.”

This view is supported by the bond market, where yields on short-term government debt have fallen in anticipation of additional rate reductions. Financial markets have generally responded positively to Banxico’s latest move, interpreting it as a sign that policymakers are proactively addressing economic headwinds.

Looking Ahead: Risks and Opportunities

While the recent rate cut provides some immediate relief for the Mexican economy, it does not come without risks. Chief among them is the potential for inflation to reaccelerate if global commodity prices rise or if the peso depreciates significantly in response to widening interest rate differentials with the United States.

Another concern is that lower interest rates could discourage foreign investment in Mexican bonds, leading to capital outflows that might further destabilize financial markets. Banxico’s decision to proceed cautiously—despite multiple indications of further cuts—is a reflection of these trade-offs.

Additionally, structural weaknesses in the Mexican economy, such as low productivity growth, underinvestment in infrastructure, and institutional inefficiencies, are unlikely to be addressed through monetary policy alone. Economists argue that without comprehensive reforms, lower interest rates may have only a limited impact on long-term growth.

Nonetheless, there are reasons for cautious optimism. If inflation remains within the target range and external shocks are minimized, Banxico could continue to reduce rates throughout the year, potentially providing a modest boost to economic activity. Moreover, improved clarity in U.S. trade policy and stronger consumer sentiment could amplify the effects of monetary easing.

Conclusion: A Strategic but Measured Approach

The Bank of Mexico’s decision to lower its benchmark interest rate for the third straight time reflects a strategic effort to navigate a complex and uncertain economic landscape. While inflation remains within acceptable bounds, the persistent weakness in economic output and the unpredictability of external factors—particularly U.S. trade and monetary policy—have compelled Banxico to act.

As the central bank continues to weigh its options, future decisions will likely depend on a combination of domestic data and global developments. For now, Banxico has signaled its willingness to support the economy with further easing, while maintaining the flexibility to pivot should inflationary pressures return.

Market participants, businesses, and consumers alike will be watching closely as the central bank’s policy evolves in the months ahead. Whether these efforts will be sufficient to steer the Mexican economy toward a more stable and prosperous path remains to be seen.