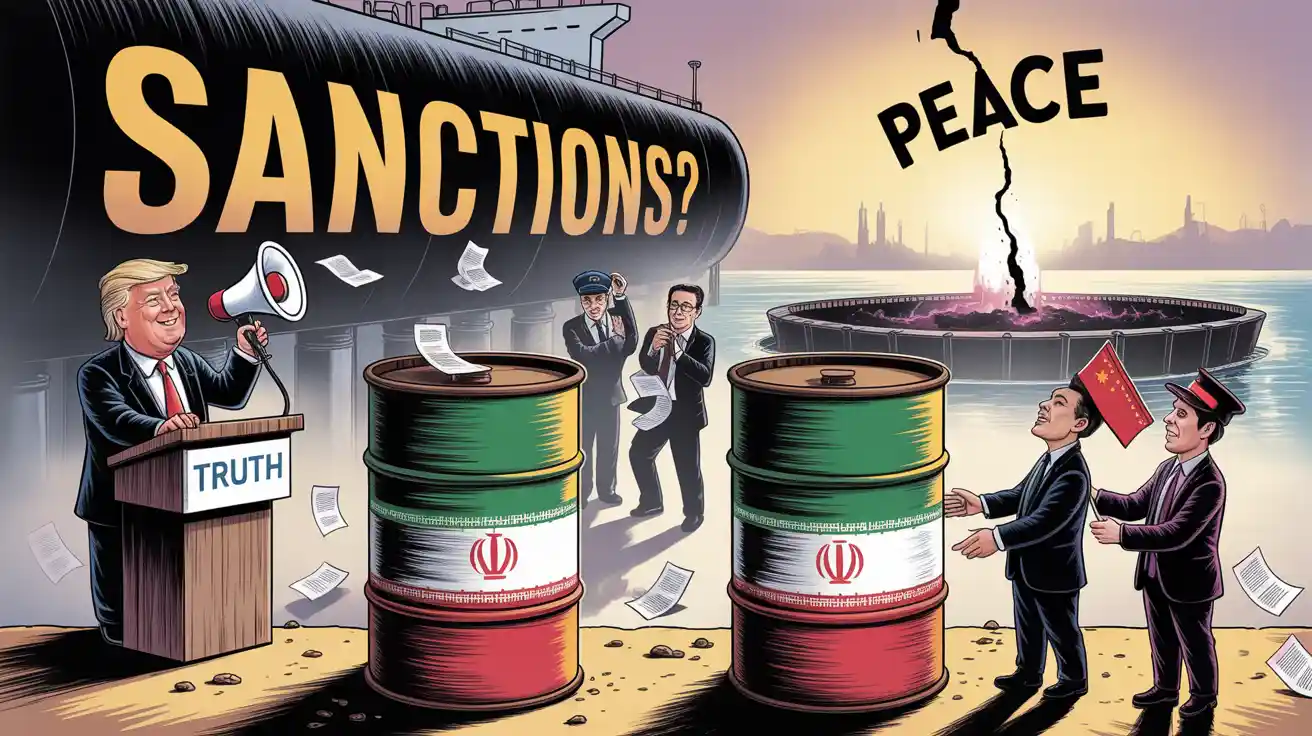

In a move that stunned Washington and global oil markets alike, former U.S. President Donald Trump abruptly reversed long-standing U.S. policy on Iranian oil exports by suggesting China can resume buying crude from the sanctioned nation — a stunning shift that could undercut years of sanctions policy across multiple administrations.

The announcement came via Trump’s Truth Social account on Tuesday, just hours after he claimed to have brokered a ceasefire between Israel and Iran, a conflict that had intensified after U.S. airstrikes hit several Iranian nuclear sites. “China can now continue to purchase oil from Iran,” Trump posted, a statement that appeared to bypass the very sanctions his administration once championed.

A Shock to the System

The sudden declaration sent shockwaves through U.S. agencies, oil markets, and diplomatic circles. Officials at both the Treasury and State Departments were reportedly blindsided, uncertain whether Trump’s remarks signaled an actual policy shift or a strategic maneuver aimed at diplomatic leverage.

As of now, the Treasury Department says it will continue enforcing existing sanctions, which aim to cripple Tehran’s oil revenue — its economic lifeline — and prevent further development of its nuclear program.

Yet the ambiguity is already complicating U.S. policy. A senior White House official, attempting to clarify the situation, stated that sanctions remain in place and that Trump’s post was intended to emphasize that his recent actions helped maintain stability in the Strait of Hormuz — a crucial oil shipping lane vital to China’s energy security.

Beijing’s Calculated Response

At a press briefing in Beijing, Chinese Foreign Ministry spokesperson Guo Jiakun responded coolly to Trump’s remarks, saying China would “take reasonable energy security measures in accordance with its own national interests.” While Beijing doesn’t officially recognize U.S. sanctions on Iranian oil, the country has continued to import barrels — often disguised as shipments from other nations — through so-called “dark fleet” tankers and alternative payment networks.

Analysts say China has never truly stopped buying Iranian oil, despite public records suggesting otherwise. With estimates placing daily imports at over 1 million barrels — often sold at a discount — Iranian oil is crucial to China’s private refineries and broader economic resilience amid domestic headwinds.

A Sanctions Carve-Out — or Strategic Messaging?

Whether Trump’s post amounts to a policy carve-out for China or mere political theater remains unclear. Some observers suggest Trump is trying to offer Beijing a concession amid fragile efforts to de-escalate the ongoing U.S.-China tariff war. Others see the message as an impulsive gesture, divorced from the established interagency coordination typically required for sanctions relief.

Mark Malek, chief investment officer at Siebert, characterized the move as “throwing a bone” to both Iran and China in recognition of their recent cooperation with the U.S., though he noted the messaging felt more rhetorical than substantive.

Regardless, the mixed signals have generated uncertainty in markets. Brent crude edged higher on Wednesday to above $68 a barrel but remains well below earlier-week highs driven by conflict in the Middle East.

A Legacy of Pressure — Undone?

The timing of Trump’s statement is especially perplexing given his recent hawkish stance on Iran. As recently as May, he demanded that “all purchases of Iranian oil must stop, NOW,” threatening secondary sanctions for violators. His administration had also sanctioned hundreds of tankers and targeted Chinese companies involved in clandestine purchases.

Under the “maximum pressure” campaign — which dominated Trump’s first term — U.S. officials sought to slash Iran’s oil exports to near zero, hoping to force the Islamic Republic to abandon uranium enrichment and halt its path toward nuclear weaponization.

Though that campaign yielded mixed results, its architecture still shapes U.S. policy today. Secondary sanctions remain intact, and any buyer of Iranian oil risks losing access to the U.S. financial system.

Strategic Risks Remain

Even with Trump’s post, legal and logistical risks for oil buyers persist. Without formal easing of sanctions, most major traders and insurers are unlikely to shift course. A sudden, unilateral shift in tone — particularly without interagency buy-in — could create confusion rather than clarity.

Further clouding the issue is the uncertainty surrounding Iran’s nuclear capacity. The International Atomic Energy Agency has yet to verify the condition of Iran’s nuclear stockpiles after the weekend strikes, which were aimed at disabling critical sites. Tehran reportedly held 409 kilograms of highly enriched uranium before the strikes — enough, some experts say, for multiple warheads.

As such, analysts warn that any perceived loosening of sanctions, even for diplomatic expediency, could send the wrong message at a delicate geopolitical moment.

Final Word — Or Just Another Post?

Trump’s unpredictable approach to diplomacy — especially through social media — has long been a hallmark of his leadership style. Whether this latest comment represents a shift in strategy or another instance of off-the-cuff messaging remains to be seen.

For now, U.S. agencies remain in enforcement mode, China maintains plausible deniability, and oil markets brace for the next surprise — all while the question lingers: Is Trump signaling a real change, or just testing the waters?